Why you need to have venture exposure now.

It is impossible not to feel the doom and gloom of the current economic forecast. After being forced at home for 2 years due to Covid, we are now able to run free – only to be stuck at home because no one has any money left. Isn’t it ironic?

Skyrocketing gas prices have made us swap trips abroad to camping locally. Rising interest rates and plummeting public market prices make everyone uneasy, and queasy. Carpal tunnel has set in as phones are checked a thousand times a day to see if there is any positive news (there isn’t). Those that made a fortune on Bitcoin are sitting on losses, now praying their NFT collections – created in the ‘Good Times’ – start to garner interest on OpenSea.

We are all just waiting.

And hoping.

And praying.

But it looks inevitable. A growing chorus of economists and financial experts predict that the US is headed into a recession.

What this means for late-stage investors

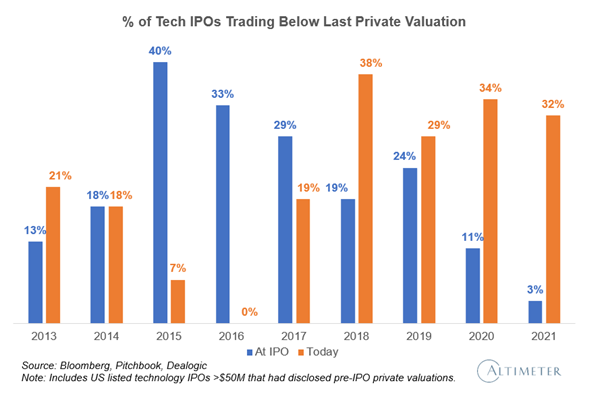

For late-stage investors, this is not good. As of today, one-third of tech companies that went public in the last four years are trading below their last pre-IPO private round valuation.

Popular food delivery companies DoorDash and Just Eat are currently down 70% since February 2021. The market is recalibrating, and this severely impacts return profiles all the way down to Series A.

What this means for seed-stage venture investors

The earlier you invest, the higher the likely returns, which is why more people are increasing their venture exposure in this turmoil. However, when facing a recession, there are some fundamental patterns which emerge that make venture investing a much more attractive asset class.

The last recession (2008) laid the foundation for astronomical growth and returns for new companies. Startups like Uber, Warby Parker, Venmo, Airbnb, Square, Slack, Dropbox, Glassdoor and many more unicorns were all founded during, or in the immediate aftermath of the global financial crisis of 2007-2009. And these brands are not alone. Historically speaking, recessions have a proven track-record for building some of the world’s greatest companies:

- Hewlett-Packard (1937-1938 Recession) is now worth $21 billion

- Hyatt Hotels (1957-1958 Recession) is now worth $5.6 billion

- Microsoft (1973-1975 Recession) is now worth $2.5 trillion

- Electronic Arts (1981 – 1982 Recession) is now worth $33 billion

- Mailchimp (2001 dot-com burst) is now worth $12 billion

- Uber (2007 – 2009 Recession) is now worth $43 billion

- Warby Parker (2007 – 2009 Recession) is now worth $1.75 billion

Whilst this is good news for Sandbox Studios’ LPs who invest at the seed and pre-seed stage, it is more useful to breakdown WHY.

1.Going back to fundamentals: Businesses can no longer “Grow At All Costs”

This strategy is particularly rife among consumer commerce businesses, where goods have high elasticity of demand. A focus on sales, rather than profit, has been a key component in pitches in the last couple of years – trying to ‘outgrow’ the nearest competitor. This is no longer a viable business strategy. The issue is not that this was wrong, but that businesses who operate on a ‘growth for growth’s sake’ model do not know how to pivot and find themselves in need of emergency funding with a pool of investors who have all raised the bar on their investments with a focus on profitability. The tables have turned, and far too fast. Many brands will not survive.

However, those that do, are businesses that have a solid business model – brands who understand their company’s unit economic formula, what its drivers are, and how to improve them over time.

This organic, self-selected, culling provides better brands in the pipeline for investors.

2. The other side of FOMO: Public markets valuation cuts have spilled over into the private market

In 2021, VC funding was $630 billion, which was more than double the previous year. It was also the year that birthed 600 unicorns (startups valuated at $1 billion), four times more than the previous year. No one wanted to miss out on the gold rush and so there was a lot of capital getting thrown around. Many funds were doing poor diligence, if they did any diligence at all – just to win the deal.

That has since reversed.

With many funds taking a huge beating since the start of this year (Tiger Global’s hedge fund lost $17 billion; Softbank Vision Fund lost $27 billion), there is now a lot of caution. No one wants to overpay – essentially, no one wants a markdown on their fund, making it very hard to raise the next one. So many funds are taking the ‘wait and see’ approach – extending their diligence and raising the bar for investment.

Those that were happy to pay 5x revenue last year on a consumer brand are now refusing to even take a first call with a brand valued at more than 2x. Like the advice they are touting, they too are conserving resources and capital.

This is great for investors because:

- Valuations will start being priced at more reasonable levels, meaning the upside is that much sweeter

- More time to do proper due diligence and gain better conviction

- Less competition means better preferences and terms

3. Risk/Reward: The younger the company, the less it has to worry about public markets

The benefit of seed-stage venture investing in such a challenging environment is that the multiples are still there. For example, if you invest in a Series C company – you might be happy to get 2-3x at the time of an IPO in a couple years’ time. However, with tech markdowns, you are now likely to get 1-2x – and also risk your investment going to zero. What is a better bet is to invest early, wait out the lull in IPO interest as the company grows, and still anticipate 20x+ multiples at time of acquisition or IPO.

The benefit in seed-stage investing far outweighs the risk – whereas in late stage investing, it hardly seems worth it.

Scott Galloway summarizes this exceptionally well outlining, “What’s the opportunity? When capital drops below the average that means the capital going into those funds that quarter will likely outperform the capital that went in during those disco days.”

*Thanks to Sandbox Studios’ LP Carlos Zaragoza for sending through this video!

But what does this have to do with celebrity brands?

Brands fuelled with star power further de-risk your investment in a Recession in the following ways:

- They provide free marketing via social media promotion to their own audience when times are tough and costs like digital marketing get cut.

- The scarier the times, the more consumers want a personal touch. Having a ‘face’ for a brand provides cut-through in times of turmoil.

- Cost-savings in multiple areas – all businesses will be hit, which enables brands to negotiate better deals with their current suppliers. B2B suppliers are typically more flexible on costs with brands that can bolster their own marketing material – ie. being able to use Ryan Reynolds’ face is a negotiation tool all the way down the chain when looking to cut costs.

- Retailers (namely Sephora, Target, Erewhon, and Walmart) know that recognizable brands drive footfall into their stores. They are more likely to stock brands associated with a celebrity, then they are to stock brands that aren’t.