Fundraising Tell-All

No one ever talks about this, mostly because Americans don’t like to self-deprecate. I suspect more fund managers in Britain are open to the warts of it all. However, I think there should be more transparency on how impossible it is to raise a Fund 1 so this is my ode to helping achieve that – with some observations along the way.

First, I want to lay the framework.

I am good at getting deals done. My career up to Sandbox Studios has been purely this. I am no stranger to pitching, creating decks, and getting difficult people to say ‘Yes’. I’m also a mother to a 2-year-old, so I’m used to being told ‘No’ a lot too. Combine my track record, a brilliant niche in investing that hasn’t been done before, and my general chutzpah – I thought raising a fund would be easy. Perhaps not easy, but certainly not the hardest thing I’ve done.

And it was.

The hardest thing I’ve done.

Not only was it long (it took me the full 18 months), but it was also painful the entire way through. Perhaps raising a first fund in a very challenging economic environment didn’t help, but I suspect it didn’t drastically alter my experience either.

Here is what I discovered:

Investors Invest in What They Know (aka New Ideas Are Bad Ideas)

For every one person who loved what we were doing (investing in celebrity-led brands), there were 100 others who did not.

When you dig into it, most people don’t understand how celebrity brands work – even the basics of how online influence can sway purchase behaviour – and most importantly why that is so powerful for growth and profits. As such, the learning curve to move an investor who has historically invested into tech or real estate is just too steep.

When you consider that 51% of angel investors have a background in technology and everyone has beared witness to unicorn exits who have made the careers of the likes of Jason Calacanis, it’s no wonder the majority of investors invest in tech. Despite 69% of the US economy being consumer directed, only 3% of venture dollars are invested into consumer goods and services (Pitchbook).

In a nutshell, if you aren’t a tech fund, you’ll have a hard time finding investors that will understand what you are doing.

This is compounded by an overwhelming majority (94%) of investors getting subject-matter experts to weigh in on evaluating an investment opportunity, reinforcing the importance of investors having access to the right tools and people to understand potential.

In hindsight, I’m still not sure my parents truly understand what I do for a living – so getting a complete stranger to fully grasp the shift in consumer behaviour on a 30min Zoom call was a long shot.

Perhaps if more people had George Clooney on speed dial, we would have been better off.

Investors That Get It, Get It – But Where Are They?

Silver lining was that when I spoke to investors who had some experience in customer acquisition/brands/talent/media they usually committed within the first call. On average it typically takes funds 3-6 months to close a new investor, so being able to do this in 30 minutes was hugely beneficial.

But finding these people was incredibly difficult.

The industry stats tell it all:

- 20 million Americans work in CPG with an average salary of $56,829

- 12 million Americans work in tech with an average salary of $104,566

- 7.69 million Americans work in finance with an average salary of $101,038

So if our sweet spot was investors working in CPG, we had to wade through more than double the people who would understand our investment thesis who made half the money of other investable industries.

Putting it bluntly, most of the people that truly understood the value of our proposition (investing in celebrity brands with intention) didn’t have the money to invest into a fund.

Stupid People Make It Hard on Everyone

When FTX, the second-largest crypto exchange in the world, collapsed with investors looking at billions of dollars in losses, it affected everyone. Even our micro-fund investing in celebrity-led brands based in West Hollywood.

On November 11th FTX and its sister firm Alameda Research filed for bankruptcy. Sandbox Studios was due to close November 12th.

Though none of our prospective investors on our final close had actual shares in FTX, that didn’t stop three investors who had committed but not signed from jumping ship all on the same day because they had a significant portion of their assets in crypto currency and panicked that they would lose it all. Understandable, but disheartening nonetheless.

These things can’t be helped, but I’ll definitely be praying for a slow news cycle for Fund 2.

Is It Worth It?

The challenge I faced with raising Sandbox Studios’ first fund – the first venture capital fund that exclusively invests into celebrity-led brands in the world – is also what makes it so great. Our entire investor base are complete legends. All the hardships of finding the right people for our fund has meant that we only have the right people in our fund.

I am not sure how it works in other funds, but Sandbox Studios investors are more than investors and supporters – they are literal cheerleaders. They have popped in on their birthday in New York to help me display our brands for a Sandbox Studios event (Patrick George), invested in bringing a portfolio company overseas (Sultan Shaker), opened up their home to host an investor dinner (Robby Riggs), pitched my fund to their entire network (Eric Francom), and so much more. It’s been a journey, but one that I’ve felt incredibly supported by with some amazing people I now get to work with.

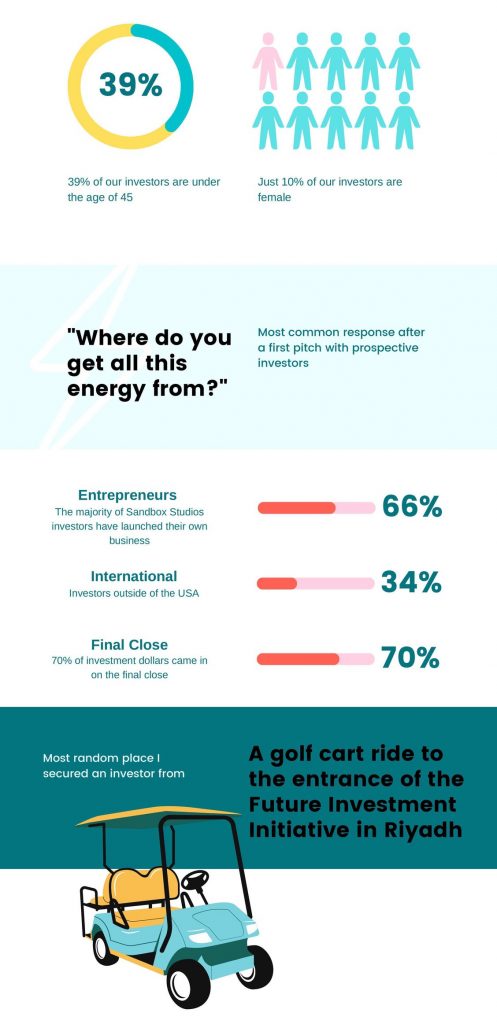

First Fund Fundraising Fun Facts

To give you an overview of what our investor demographic is for Sandbox Studios, here are some interesting stats:

Now the real work begins!