Silicon Valley Bank was shut down by the Federal Deposit Insurance Corporation on Friday, March 10th for running out of money. Despite where you fall on why this bank run occurred, it is unlikely you fell into the camp of knowing anything about the FDIC insurance limit of $250,000 – or, like me, even knowing a bank could run out of money.

Within the hours that followed, the entire venture community and all startups spent countless hours trying to unpick what might happen over the weekend. I spent 8.5hrs on hold with the FDIC (they never did answer), whilst trying to refresh my browser in a vain hope to process wire transfers.

In the end, the FDIC prevailed and all depositors were made whole.

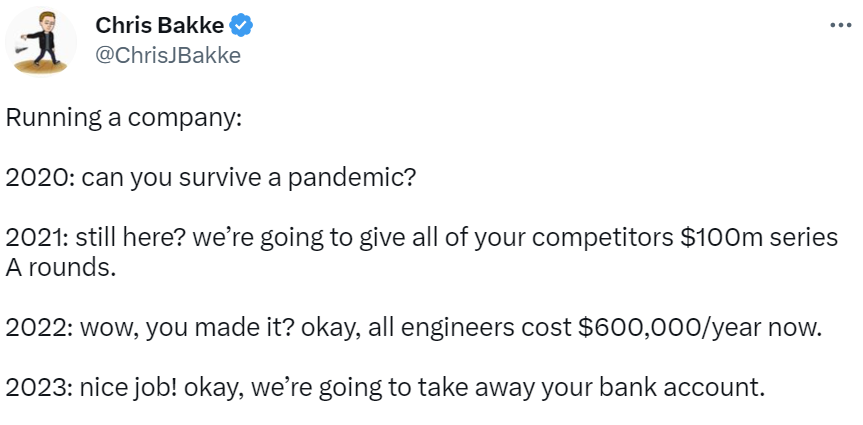

We are still in the aftermath of understanding what the venture and startup community will do despite SVB recently being purchased by First Citizen’s Bank. However, the turmoil, confusion, and concern has further mired an industry that has already had many recent setbacks.

In the third quarter of 2022, VC funding totaled just $81 billion, according to Crunchbase. That’s 33% ($40 billion) less than the previous quarter, and 53% ($90 billion) less than in 2021.

Saying it is financially harder for startups is an understatement. With over 70% of all startups relying on founder capital for their initial growth, any strain on the financial system is a strain on the overall system. Any hiccups in the road can crush a startup – whether that is raising additional capital from outside sources or a run on the bank.

This constraint does not impact celebrity brands the same way

The benefit of celebrity brands is that a celebrity founder is unlikely to be slumming it. Not bogged down with the decision to pay rent or pay staff. Very unlikely to be eating beans on toast for a summer to pay for manufacturing. As such, this additional capital bandwidth can see celebrity-brands through the inevitable tough times.

In a nutshell, a celebrity brand won’t fail because it ran out of money.

In these challenging times ahead, this is a significant advantage.

The bankruptcy of Forma Brands

Forma Brands is the incubator to popular beauty brands such as Morphe, Morphe 2, Jaclyn Cosmetics, Bad Habit, Lipstick Queen, Playa Beauty and Ariana Grande’s r.e.m Beauty. Following a string of supply chain issues and store closures, Forma filed for Chapter 11 bankruptcy protection on January 17th, 2023.

Unsurprisingly, the only beauty brand rescued in the entire portfolio – by Ariana Grande herself – was r.e.m. Beauty. The agreement to purchase r.e.m.’s physical assets, including existing inventory, from Forma Brands is valued at roughly $15 million.

Despite what many deem as a risky business, celebrity brands are actually less risky – especially during challenging economic times. Which is why we are entering the rise of celebrity brands. Not because it’s trendy, but because they work. This is compounded in challenging economic climates due to the nature of reduced costs of acquisition, the buffer of financial stability, and the halo effect helping these brands win shelf space in key retailers.

If you haven’t been taking the growth in celebrity brands seriously, it is high time you start.