Investments announced by r.e.m. beauty, Henry Rose, and Ceremonia – all led by one investor

While the rest of the market stagnates, that has not been the case for many celebrity-led brands who have had major announcements in the past month alone. Sandbridge Capital, new entrant in celebrity brands, being one of the most active investors in the space as of late. Their latest deal announced May 23rd into r.e.m. beauty – the award-winning beauty brand founded by multi-talented Grammy winner, singer, and actress Ariana Grande.

Sandbridge Capital

Based in Los Angeles, Sandbridge Capital have a front-row seat to the successes (and failures) of many celebrity brands and have recently become exceptionally active.

With r.e.m. beauty, Sandbridge Capital Founder and Managing Partner Ken Suslow commented: “r.e.m. beauty has earned the trust of the beauty community and consumers alike by creating an impressive best-in-class line of products inspired by Ariana’s compelling mission driven brand vision. We are thrilled to come together with Ariana and her stellar r.e.m. team in support of the brand’s strong growth trajectory through our global industry network and brand building expertise.” Read full press release here.

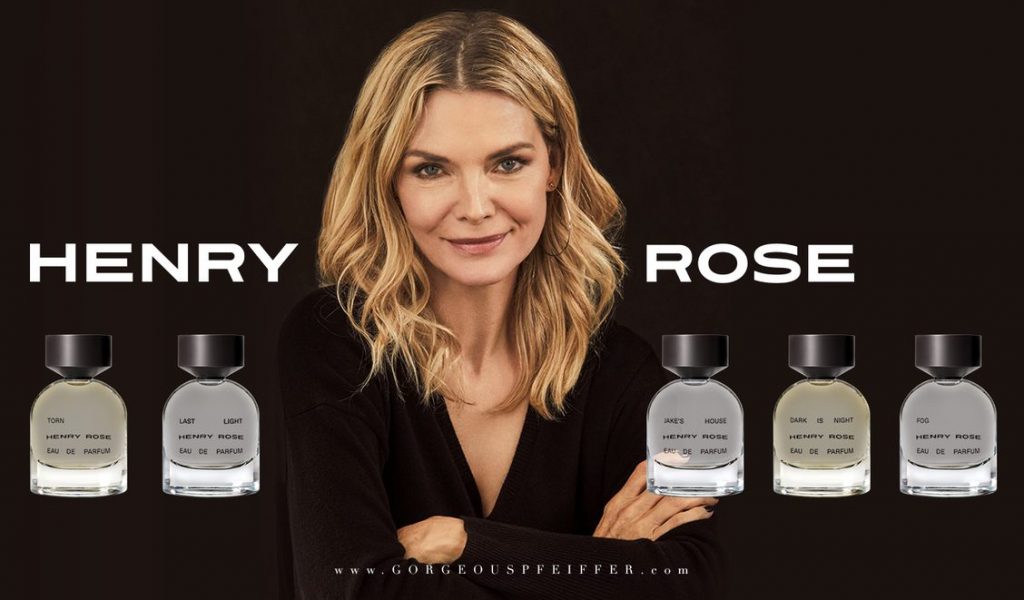

Interestingly, this isn’t the first celebrity-led brand Sandbridge Capital has led in the last month. In addition to r.e.m. beauty, Sandbridge Capital has also led the Series A for Michelle Pfeiffer’s genderless fine fragrance brand Henry Rose and led the Series A investment round for Ceremonia, the Latinx clean hair care brand founded by influencer and business woman Babba Rivera.

These three talent-led deals were all announced in the space of 4 weeks.

It is also worth noting that this is a departure from their previous consumer investments that haven’t featured talent – namely their investments into ILIA, Youth to the People, Thom Browne, Peach & Lily, U Beauty, Farfetch and Rossignol.

Which leads to query, why the sudden change?

Arguably it is because they understand consumer brands, and consumer appetite, better than most investors – and can see the trend of these brands leading to stronger exits. There are many variables at play in talent-led brands that many investors are not privy to. Understanding this mix and how it plays into growth, and an eventual exit, is vital. Those that do well, do extraordinarily well.

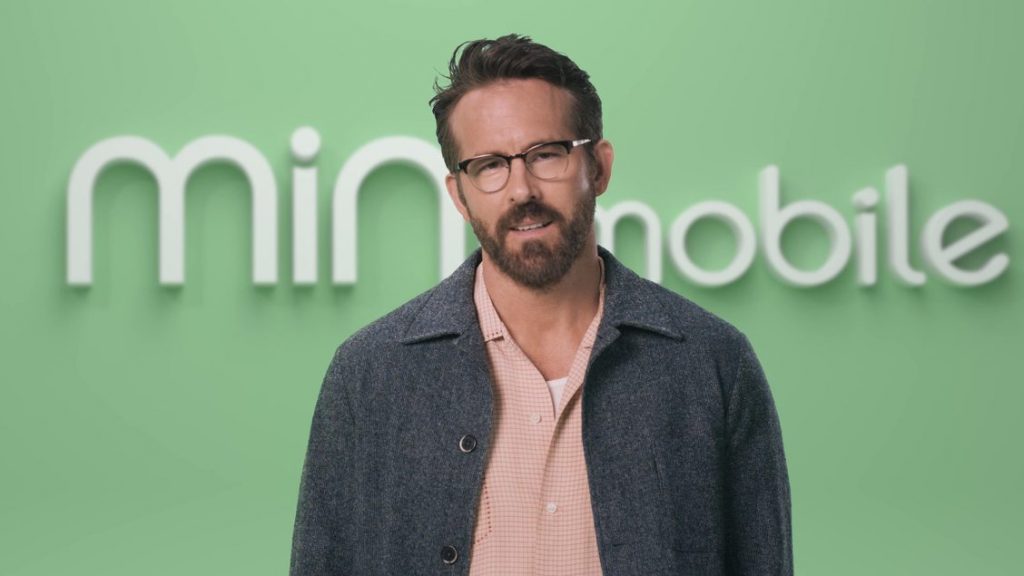

Ryan Reynolds & Mint Mobile

A great example is the recent acquisition of Mint Mobile for $1.35 billion of which Ryan Reynolds partially owns – a deal reportedly worth over $300m personally.

Reynolds is known for getting into the right deals. However, that undervalues his true value-add to a deal. Reynolds works exceptionally hard to build the brands he is involved with by utilizing his raw talent for storytelling, comedy, and marketing. It is his involvement which makes the deals he is involved with turn into the ‘right deal’. Not the other way around.

So, if you are tired of looking at SaaS valuations that have flatlined, perhaps you should review what’s going on with celebrity brands. Despite some well-publicized wins (Casamigos, Kylie Cosmetics, Skims), the market is nascent and the opportunities for significant upside are abundant.