What this really means for investors

Despite what you might think of her, Kim Kardashian is unique.

Having rose to fame from being Paris Hilton’s (likely unpaid) assistant to a current estimated net worth of $1.8bn, according to Forbes, she has done something remarkable. Following appearing on her family’s show “Keeping Up With the Kardashians” she has seen astronomical entrepreneurial success with Skims ($3.2bn after 2 years), SKKN ($1bn pre-launch), and recently passing the Baby Bar Exam.

Even the most critical would be impressed.

What is not unique is another A-list celebrity launching an investment vehicle. Stars with similar portfolios include Will Smith, Snoop Dogg, Gwyneth Paltrow, Jay-Z, Ashton Kutcher, Steph Curry, Bono, Serena Williams, The Chainsmokers, Aaron Rodgers and P-Diddy – all with varying investment purposes, and all with varying degrees of success.

Surprisingly, she was only approached to do the fund earlier this year.

Had I known, I probably would have suggested it sooner.

The cornerstone of the fund is Jay Sammons, a former partner at the investment firm Carlyle Group. Having led previous investments in Beats, Supreme, Vogue, and Moncler – his area of interest aligns well with the types of brands that Kim has been successfully founding.

However, a private equity firm is not a brand – which begs the question: How will this actually work?

With little published information about the fund aside from stating that they will take “both controlling and minority investments into hospitality, luxury, digital and e-commerce sectors”, which is just a fancy way of saying “We are going to invest in everything” (or potentially, “We aren’t quite sure how we are going to invest yet”) there is a lot left to the imagination.

My hot take on what this will look like in the coming years

1.If Kim isn’t posting, then is she really there?

Or put plainly, ‘How will Kim add value to SKKY’s portfolio?’.

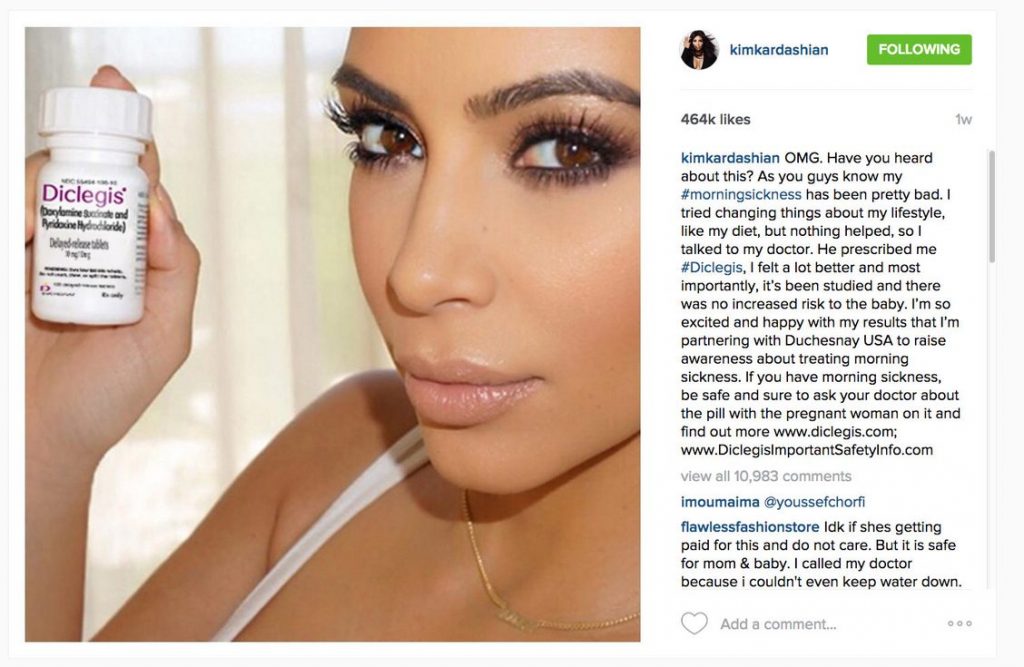

Kim Kardashian has proven that she is a money maker. She understands how to create content that people want, and she has a proven track record of building businesses that can convert customers. With over 330m followers on Instagram, even if 0.005% buy her promoted products (which is an average Kardashian conversion rate on day 1 of posting) that equates to $1m in sales for her Skims bodysuit ($58).

The issue is, will and can Kim post for her portfolio companies?

It’s unlikely.

Assuming SKKY will make 20 investments, it would not be prudent for Kim to do any posting at all – for fear of cannibalising the audience that she has coveted so dearly.

So if she’s not posting and instead providing ‘“entrepreneurial advice”, how competitive can SKKY really be? Which leads me to…

2. Will portfolio companies benefit?

For the very best of brands raising capital, competition is fierce amongst investors. Getting into a deal is often one of the critical areas that makes a fund successful. Funds that lack social skills, a good network, and serious value add never, ever get into the best deals. And if you can’t get into the best deals, then your fund will never perform well enough to raise subsequent capital.

“Together we hope to leverage our complementary expertise to build the next generation Consumer & Media private equity firm”, said the reality star in a tweet.

Though I do believe Kim has a lot of knowledge she could disseminate that would help founders, I’m not entirely sure we could call her an operator. Equally I don’t think many founders are looking to star in reality TV shows and have sex tapes revealed.

But maybe I’m wrong on that one.

3. It pays to differentiate

Private equity firms raised $1.8 trillion in capital in 2021. Having Kim as a partner not only differentiates this new firm from other private equity firms looking to secure capital, but it also likely makes it very easy to raise.

Being able to raise capital quickly and start investing immediately (because now really is the time to invest) is a huge advantage for SKYY.

4. Content is king

Jokes aside, if Kim was to leverage her expertise on content creation and rope in her network of high-profile friends to support a founder in need then this would really move the needle. However, from speaking to one of the celebrities mentioned above who does have a venture fund, they explicitly stated that they, “don’t invest in consumer brands otherwise every founder would expect us to post and promote their brand every time we made an investment – which is not achievable, valuable, or reasonable.”

I expect there is middle ground when push comes to shove with an acquisition or otherwise that Kim becomes available. This would be serious leverage.

Because content truly is king in our current media landscape.

This announcement sparked a ton of interest in the media and investment community. More than any other A-list fund launch to date. Maybe it’s because it’s a Kardashian, or maybe because this is the tide turning and we are about to see a slew of more celebrity brands in the not too distant future.

I’m obviously banking on the latter.